Industry News

U.S. Takes Action on Copper Imports to Protect National Security

July 31, 2025

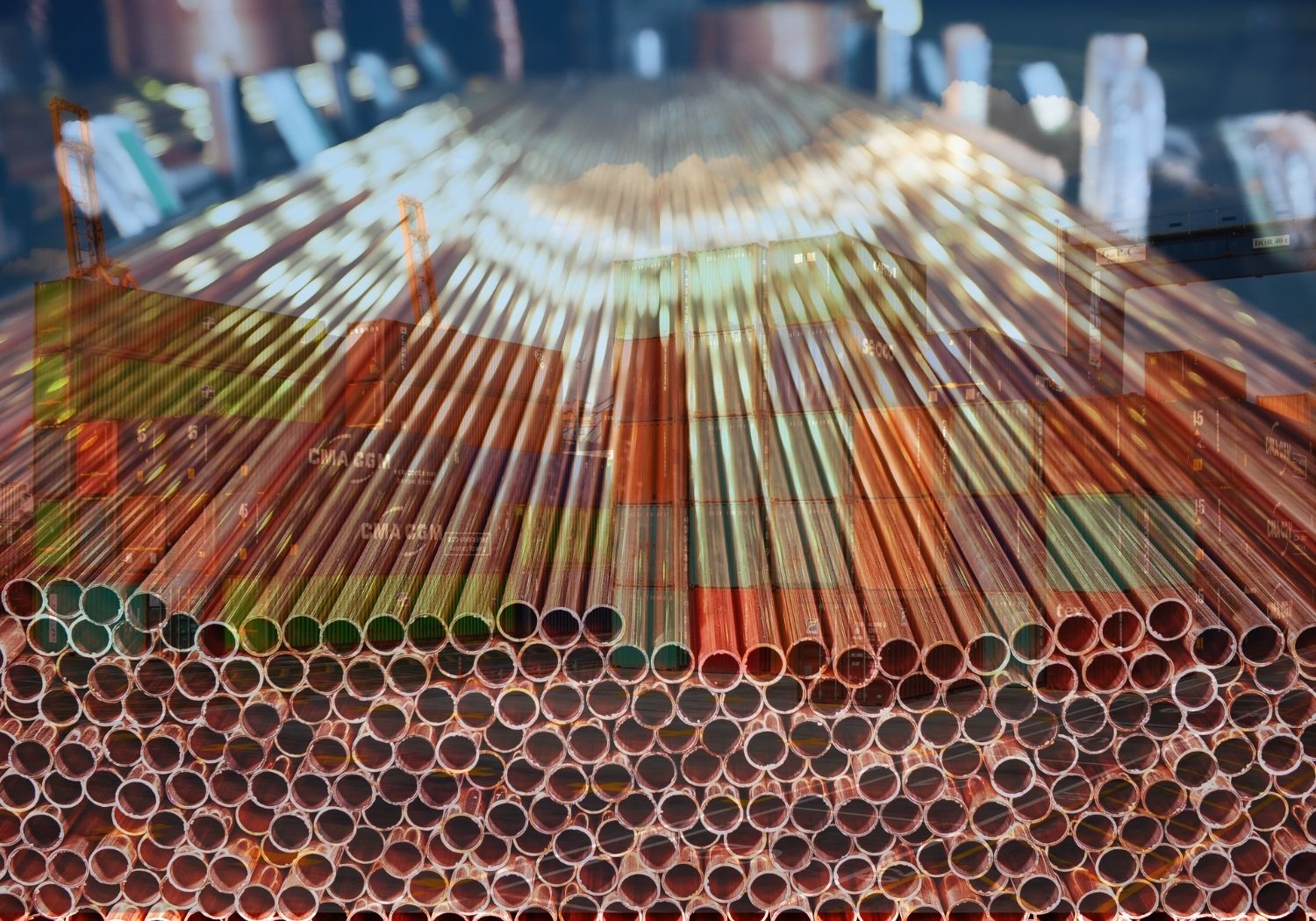

President Donald J. Trump has signed a proclamation to impose new trade measures targeting copper imports, citing national security risks and the need to strengthen the U.S. copper industry. The new rules take effect on August 1, 2025, and include significant tariffs, domestic sourcing requirements, and strict compliance documentation for importers. New trade measures include:

Tariff Rate : 50% tariff on semi-finished copper products and copper-intensive derivatives

- Includes pipes, wires, rods, sheets, tubes, pipe fittings, connectors

- Applies only to the copper content (not the total value of the good)

- Does not apply to: copper ores, concentrates, cathodes, anodes, or copper scrap

- No double tariffs if already subject to Section 232 auto part duties

Domestic Copper Supply Requirements

-

Effective immediately: 25% of high-quality copper scrap must be sold domestically

-

Starting 2027 25% of copper input materials produced in the U.S. must be sold domestically. This threshold rises to 30% in 2028 and 40% in 2029

-

Export licensing is encouraged for outbound shipments of high-grade scrap

Importer Documentation Requirements

- Importers must retain and provide documentation verifying the value of the copper content, including:

- Invoices

- Bills of materials

- Accounting and production records

-

If insufficient documentation is provided, Customs and Border Protection (CBP) may apply the 50% tariff to the full value of the product

-

Underreporting may result in severe penalties, including fines, import privilege revocation, or criminal liability

Additional Compliance Information

- Foreign Trade Zones: Products subject to this tariff must be admitted under “privileged foreign status” unless classified as “domestic status”

- Drawback Restrictions: No drawback (duty refunds) will be available on duties imposed under this proclamation

- IEEPA Exception: A reciprocal tariff exemption may apply under 9903.01.33, consistent with IEEPA provisions

- Effective Time: Applies to goods entered or withdrawn for consumption on or after 12:01 a.m. EDT, August 1, 2025

To view the full guidance published by the the CBP, visit CSMS# 65794272

To view the factsheet, visit Whitehouse.gov